Charlie and I allocate your savings at Berkshire between two related forms of ownership. First, we invest in businesses that we control, usually buying 100% of each. Berkshire directs capital allocation at these subsidiaries and selects the CEOs who make day-by-day operating decisions. When large enterprises are being managed, both trust and rules are essential. Berkshire emphasizes the former to an unusual – some would say extreme – degree. Disappointments are inevitable. We are understanding about business mistakes; our tolerance for personal misconduct is zero.

查理和我主要通过投资两种高度相关的股权类型来配置大家的储蓄资金。首先,我们投资于可以控股的公司,这一类我们通常选择100%收购。伯克希尔公司指导这些公司如何进行资源配置并帮助他们选出适合的CEO。在管理大型企业时,信任和规则都是必不可少的。伯克希尔公司非常强调前者,我们对业务错误有较高的容忍度,但对个人不当行为的容忍度为零。

In our second category of ownership, we buy publicly-traded stocks through which we passively own pieces of businesses. Holding these investments, we have no say in management. Our goal in both forms of ownership is to make meaningful investments in businesses with both long-lasting favorable economic characteristics and trustworthy managers. Please note particularly that we own publicly-traded stocks based on our expectations about their long-term business performance, not because we view them as vehicles for adroit purchases and sales. That point is crucial: Charlie and I are not stock-pickers; we are business-pickers.

我们的第二类投资方式是通过购买公开交易的股票持有企业股份股权。对于这些投资,我们在管理上没有发言权。但我们的目标是,在拥有长期有利的经济特征和值得信任的管理者的企业中进行有意义的投资。需要注意的是,我们持有这类股票,是基于对公司长期业务表现向好的判断,而不是将其看作是短期买卖的工具。这一点非常重要:查理和我不是选股专家,而选企业的专家。

Over the years, I have made many mistakes. Consequently, our extensive collection of businesses currently consists of a few enterprises that have truly extraordinary economics, many that enjoy very good economic characteristics, and a large group that are marginal. Along the way, other businesses in which I have invested have died, their products unwanted by the public. Capitalism has two sides: The system creates an ever-growing pile of losers while concurrently delivering a gusher of improved goods and services.

多年来,我犯过很多错误。因此,虽然我们目前的投资组合中有一些具有真正非凡经济效益的企业,但也有一部分企业已经倒闭,它们的产品不受公众欢迎。资本主义有两面性:这个体系在造就越来越多的输家的同时,也提供了大量的改善型商品和服务。

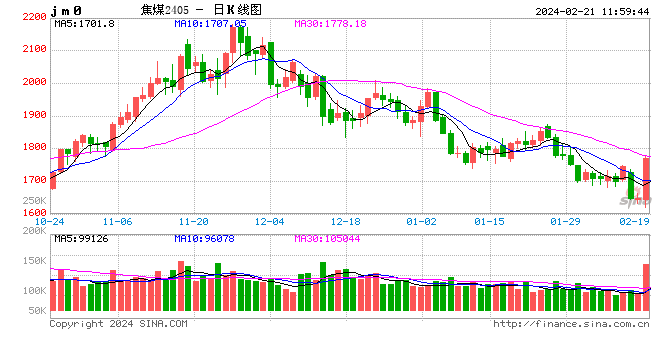

One advantage of our publicly-traded segment is that – episodically – it becomes easy to buy pieces of wonderful businesses at wonderful prices. It’s crucial to understand that stocks often trade at truly foolish prices, both high and low. “Efficient” markets exist only in textbooks. In truth, marketable stocks and bonds are baffling, their behavior usually understandable only in retrospect.

我们在公开交易市场的一个优势是,偶尔可以很容易地以极好的价格买进优秀的企业。股价交易的价格往往非常离谱,有可能会很高,也有可能会很低,“有效”市场只存在于教科书中。事实上,市场上的股票和债券价格常常令人困惑,通常只有在事后才能将其理解。

Controlled businesses are a different breed. They sometimes command ridiculously higher prices than justified but are almost never available at bargain valuations. Unless under duress, the owner of a controlled business gives no thought to selling at a panic-type valuation.

控股企业的情况则有所不同,有时它们的价格高到离谱,但几乎不会出现便宜的估值。除非是在迫不得已的情况下,不然控股企业的所有者不会考虑以恐慌性的估值进行出售。

以上内容节选自《巴菲特2023年致股东信》

由数字人巴菲特播报

添加新评论